2022-08-10

Interim report for 1 January – 30 June 2022

Accelerating growth momentum and upgrade of 2022 outlook.

Highlights H1 2022

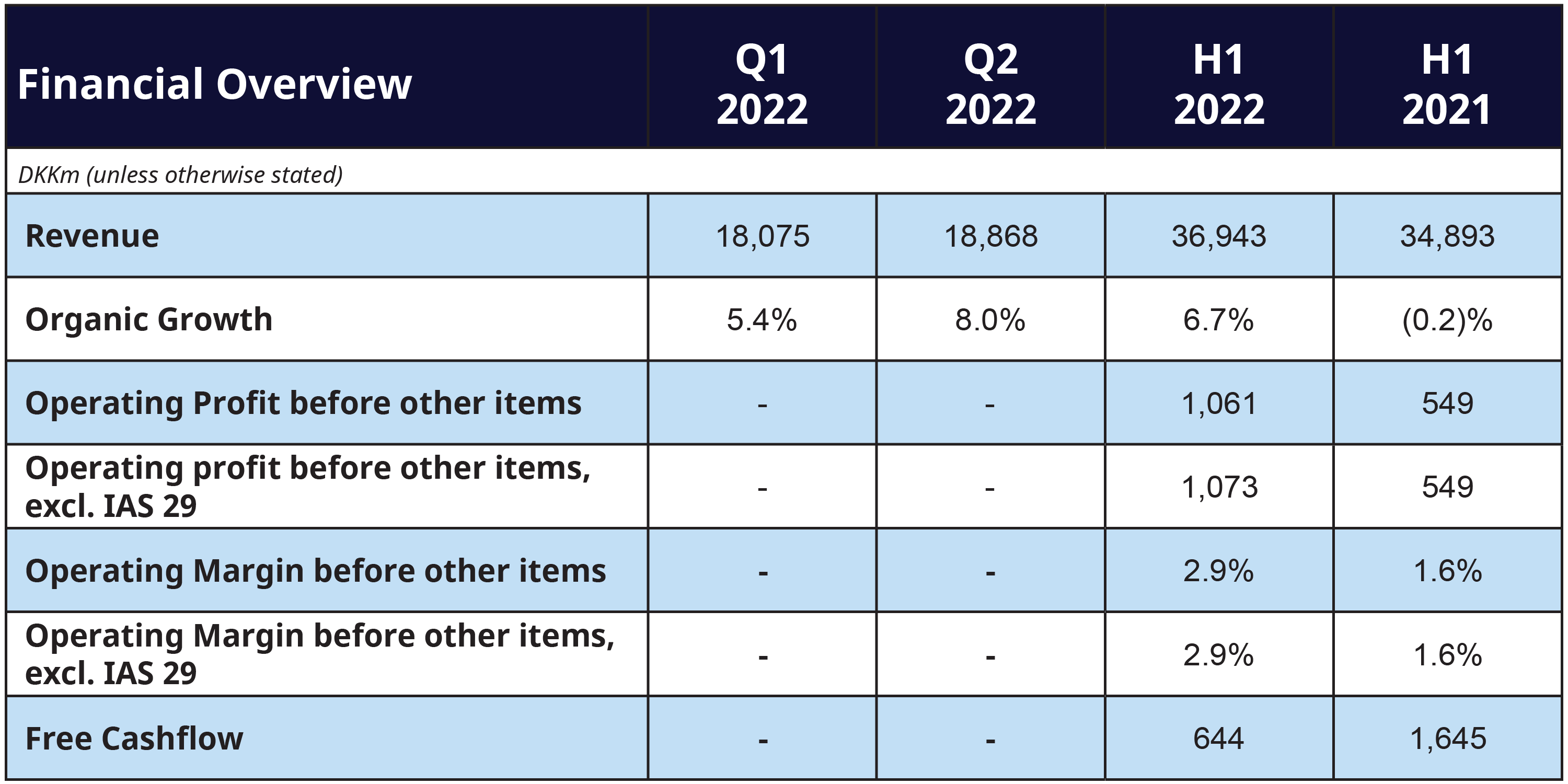

Organic growth and revenue

Operating margin

Free cash flow

Turnaround targets

Divestment programme

Inflation

Capital Markets Day

Outlook

Outlook for 2022

Above 5%*

Organic growth

Above 3.75%*

Operating margin

DKK 1.5 billion*

Free cash flow

“

The results in the first half of 2022 mark another important milestone in our financial turnaround.

Jacob Aarup-Andersen, Group CEO, ISS A/S

Contacts and downloads

Need more information?